The 7-Second Trick For Hsmb Advisory Llc

The 7-Second Trick For Hsmb Advisory Llc

Blog Article

The 15-Second Trick For Hsmb Advisory Llc

Table of ContentsAll About Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You BuyThe Hsmb Advisory Llc PDFsThe Ultimate Guide To Hsmb Advisory LlcGetting My Hsmb Advisory Llc To WorkHsmb Advisory Llc Fundamentals Explained

Ford states to stay away from "cash worth or irreversible" life insurance policy, which is more of a financial investment than an insurance policy. "Those are extremely complicated, included high payments, and 9 out of 10 individuals don't require them. They're oversold since insurance coverage agents make the biggest payments on these," he states.

Handicap insurance policy can be costly, however. And for those who choose for long-lasting care insurance policy, this plan may make handicap insurance coverage unneeded. Review a lot more concerning lasting treatment insurance and whether it's ideal for you in the following area. Long-lasting care insurance policy can assist pay for expenditures related to lasting care as we age.

Facts About Hsmb Advisory Llc Uncovered

If you have a persistent wellness worry, this kind of insurance policy could finish up being essential (St Petersburg, FL Life Insurance). Nevertheless, do not let it stress you or your checking account early in lifeit's normally best to obtain a policy in your 50s or 60s with the expectancy that you won't be utilizing it till your 70s or later.

If you're a small-business proprietor, consider protecting your income by purchasing organization insurance coverage. In the event of a disaster-related closure or duration of rebuilding, business insurance can cover your revenue loss. Take into consideration if a substantial weather condition event affected your store front or manufacturing facilityhow would certainly that affect your earnings?

And also, utilizing insurance policy could in some cases cost greater than it saves in the future. If you get a chip in your windshield, you may take into consideration covering the repair service expense with your emergency savings rather of your car insurance policy. Why? Due to the fact that utilizing your auto insurance can trigger your regular monthly costs to go up.

Hsmb Advisory Llc Things To Know Before You Get This

Share these suggestions to safeguard loved ones from being both underinsured and overinsuredand seek advice from a relied on specialist when required. (https://www.cheaperseeker.com/u/hsmbadvisory)

Insurance that is acquired by an individual for single-person protection or insurance coverage of a household. The specific pays the premium, as opposed to employer-based medical insurance where the employer usually pays a share of the premium. Individuals may purchase and acquisition insurance coverage from any strategies readily available in the individual's geographical region.

People and family members might certify for financial aid to lower the cost of insurance policy costs and out-of-pocket prices, however only when signing up via Connect for Health And Wellness Colorado. If you experience particular adjustments in your life,, you are eligible for a 60-day time period where you can sign up in an individual plan, even if it is beyond the annual open registration period of Nov.

The Ultimate Guide To Hsmb Advisory Llc

- Link for Health And Wellness Colorado has a full list of these Qualifying Life Occasions. Dependent children who are under age 26 are qualified to be consisted of as member of the family under a parent's insurance coverage.

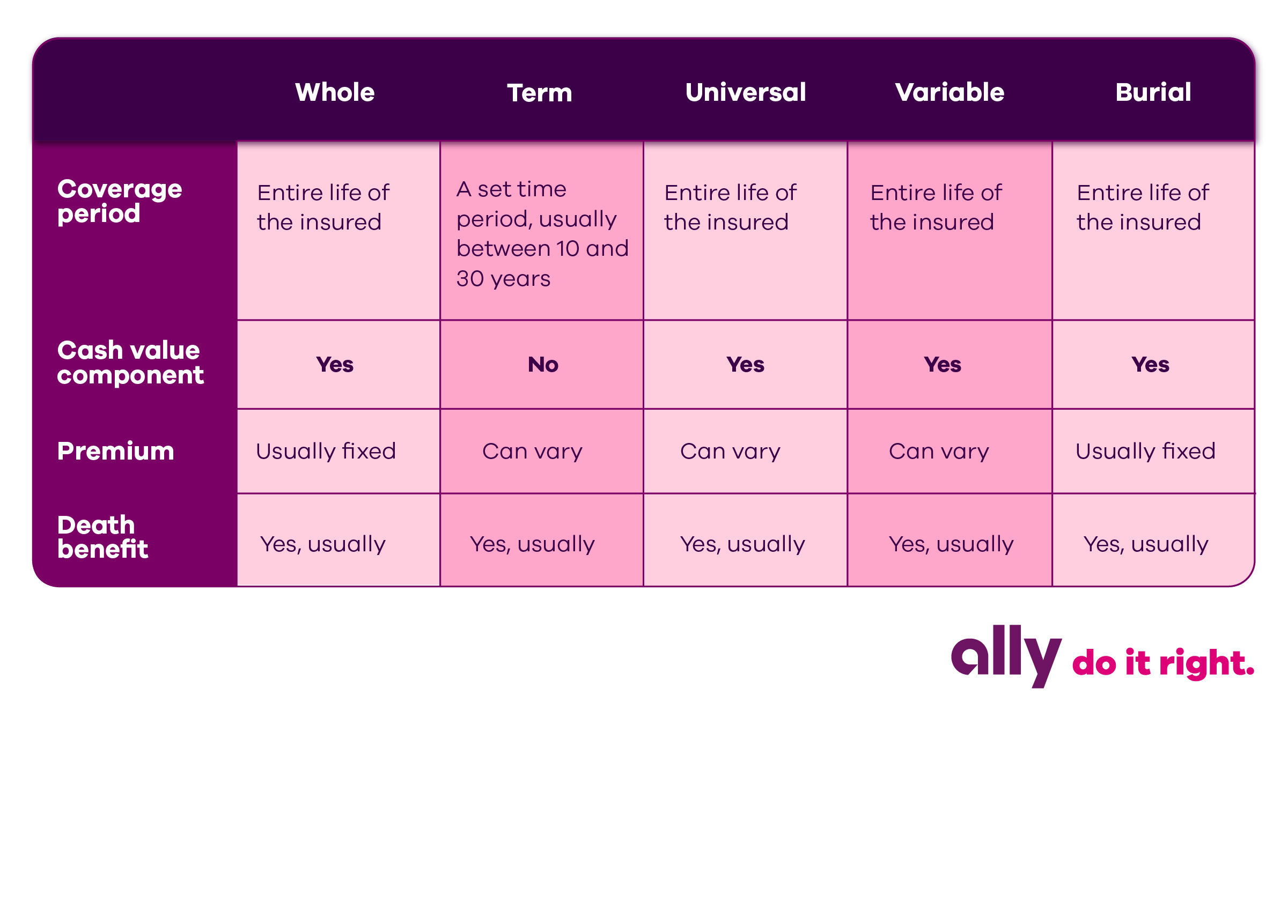

It may appear simple but recognizing insurance coverage types can likewise be confusing. Much of this confusion comes from the insurance policy sector's ongoing goal to develop customized insurance coverage for policyholders. In making adaptable policies, there are a selection to select fromand all of those insurance types can make it tough to comprehend what a specific plan is and does.Hsmb Advisory Llc for Dummies

If you die throughout this duration, the person or people you've called as recipients may obtain the cash money payment of the policy.

However, many term life insurance policy policies allow you convert them to an entire life insurance policy, so you don't shed insurance coverage. Normally, term life insurance policy plan premium repayments (what you pay each month or year into your policy) are not secured at the time of acquisition, so every five or ten years you possess the policy, your premiums might increase.

They also tend to be less costly total than whole life, unless you get a whole life insurance policy when you're young. There are also a few variants on term life insurance. One, called team term life insurance policy, is usual amongst insurance coverage choices you may have accessibility to with your employer.Hsmb Advisory Llc Can Be Fun For Anyone

This is commonly done at no charge to the worker, with the capacity to buy additional coverage that's gotten of the staff member's income. An additional variation that you might have access to with your employer is additional life insurance (Health Insurance). Supplemental life insurance can consist of unexpected death and dismemberment (AD&D) insurance, or burial insuranceadditional protection that can assist your family members in case something unanticipated takes place to you.

Long-term life insurance policy simply refers to any home kind of life insurance policy policy that doesn't expire. There are a number of kinds of long-term life insurancethe most common types being whole life insurance policy and global life insurance policy. Whole life insurance is exactly what it appears like: life insurance policy for your entire life that pays to your recipients when you die.

Report this page